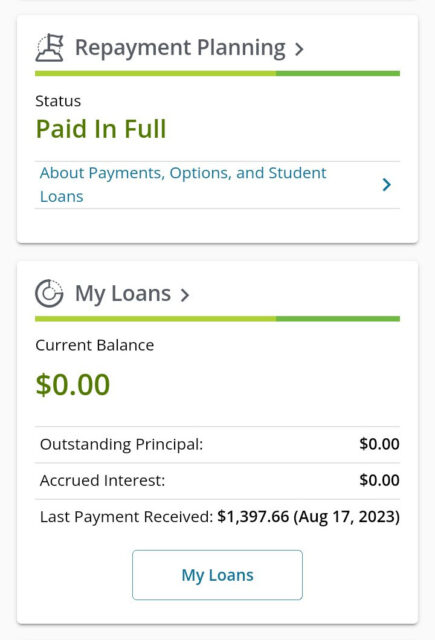

This morning I logged into Nelnet, my student loan servicer, and I was greeted by a wonderful surprise.

My student loans from the University of Richmond, taken out twenty-five years ago, give or take, are gone. Paid off. Forgiven.

I received an email about a month ago from the Department of Education. Hold on, let me find it.

July 14.

Subject line: “You’re eligible to have your student loan(s) forgiven!”

On April 19, 2022, the Biden-Harris Administration announced several changes that will help borrowers get closer to or achieve forgiveness under income-driven repayment (IDR) regardless of whether or not you have ever participated in an IDR plan. With these changes, you are now eligible to have some or all of your student loans forgiven because you have reached the necessary 240- or 300-months’ of payments under IDR.

I left Richmond with about 30k in student load debt. All in all, not a terrible load. Some of it was a Perkins Loan. Some of it was Stafford Loans, both subsidized and unsubsidized. It was a little bit of a struggle at first, and I think my payments amounted to about $260 a month. I remember talking about it with my dad in late 2000 or early 2001, and I remember him being shocked that it was so much. But EB Games paid me decently well, and it wasn’t a challenge.

I consolidated in 2003 after I moved to Raleigh. I wasn’t interested, frankly, but Great Lakes called and called and kept calling, and I finally gave in just to stop the phone calls. It bundled the two loans payments together — the monthly Stafford payments, the quarterly Perkins payments (which I had a habit of forgetting, because it was quarterly) — and reduced my payment by about $100 a month, and I went to a 20-year term, extending the loans out to 2023. They’d have been paid off this year anyway.

In retrospect, I’m glad I consolidated back in 2003. Paying $260 a month at EB was not a problem. Trying to pay that at Diamond would have been a disaster. EB paid well. Diamond did not. Comics was a massive pay cut. In real dollars, I’m finally making more now than I did in 2006. In inflation adjusted dollars, I am not.

And then COVID happened.

My consolidated loans were not eligible for the payment pause, and I paid them through 2020 and 2021. In 2022 I learned that if I reconsolidated my loans back into federal direct loans, I could take advantage of the payment pause. So that’s what I did. And when Joe Biden announced his student loan forgiveness program, I submitted the application last Labor Day weekend, and around Thanksgiving I had an email that I’d been approved.

At that point, I had about $3,300 left, and the new loan term was for five years at $50 a month. I’m not sure how that math works out, but that’s what Nelnet’s dashboard claimed. Anyway, the point is, in order to take advantage of the COVID payment pause, not expecting the forgiveness program, I added five years to my loans from whenever they restarted. And, thanks to the Supreme Court’s decision in June, that they’re kings and the plain text of the law doesn’t matter a damn, my student loans would finally be extinguished in 2028.

The day of the Supreme Court decision, I logged into Nelnet and made a payment. “Getting myself back on that treadmill,” I said. I had an approach in mind to getting these loans gone. I was going to pay biweekly, sixty percent of my monthly payment every two weeks. In other words, thirty dollars every paycheck, $780 a year instead of $600. The next paycheck, I made another payment.

And then, about an hour later, I received that email from the Department of Education.

I’ve heard them described as “Golden Tickets,” like Willy Wonka’s chocolate bars.

I was never on an income-driven repayment plan. I’m not even sure I knew about income-driven repayment plans. I don’t really know how this forgiveness plan worked, except maybe it amounted to, “You’ve been paying on this student loans since before the Y2K bug, and that’s long enough.”

I didn’t expect it. I’m not questioning it. All I know is that, as of this morning, I no longer have a student loan balance.

Thank you, Miguel Cardona. Thank you, Department of Education. Thank you, Joe Biden.

Dark Brandon delivered!